A key concept behind the idea of “Time Value of Money” is the idea of compound interest, that is, the idea that the returns of an investment will be used at a later period to generate their own returns.

As such we often need to calculate the future value of such an investment, in order to determine what the total amount available to us will be at a given time.

Future Value of a Single Sum

The simplest future value to calculate is the future value of a single sum.

In essence the question we are asking ourselves here is:

If I invest X dollars today, how many dollars will I have in Y years?

And so in order to answer this we need to know a few things:

How many dollars am I investing today? → Present Value

What’s the return I am getting for the investment → Interest Rate

How long am I investing it for? → Number of Periods

If we put it all together we get the answer to the question:

How many dollars will I have at the end? → Future Value

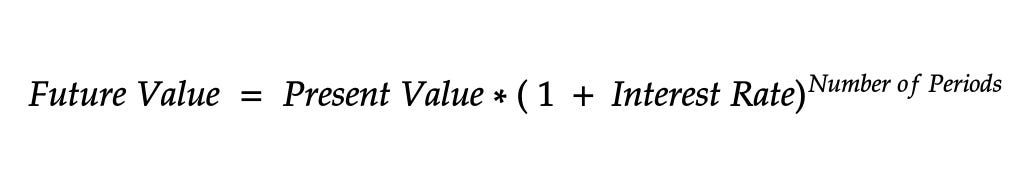

And of course, the formula to calculate is:

For a simple example, we can calculate as such:

Present Value → 100

Interest Rate → 0.1

Number of Periods → 1

This means that our Future Value is:

Future Value → 110

We can also use this formula in other ways in order to for example account for different interest rates for different periods, or additional capital invested at different times.

In order to do that, we simply need to break down the returns into its component parts, and then add it all up.

For example if we are trying to calculate the future value of $100 in 2 years, where the first year has an interest rate of 10%, and the second year has an interest rate of 20%, then we simply do the following:

First we calculate the Future Value of the first year:

Present Value → 100

Interest Rate → 0.1

Number of Periods → 1

Future Value at End of First Year → 110

And then we use that to calculate the Future Value of the second year:

Present Value → 110

Interest Rate → 0.2

Number of Periods → 1

This means that our Future Value is:

Future Value → 132

Present Value of a Single Sum

On the other hand, when we are calculating the Present Value of a Single sum, we are essentially doing the reverse.

We are asking ourselves:

If I want to have X dollars after Y years invested at Z interest rate, how much do I need to invest now?

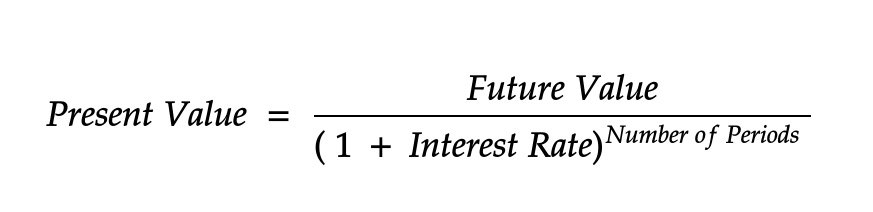

And so the formula to use is:

And so for this we can simply calculate a simple example:

Future Value → 100

Interest Rate → 0.1

Number of Periods → 1

This means that our Future Value is:

Present Value → 90.909…

And so we can double check that this is accurate by using the future value formula described above.

Present Value of a Perpetuity

What happens though when the returns you”re getting go on forever?

Does that mean that perpetuities (or other assets similar to perpetuities, like stocks) have infinite value?

No, of course not, because of the concept of “Time Value of Money”.

In other words, in order to get the Present Value of a stream of cashflows, we need to discount those cashflows by the appropriate discount rate.

So how do we calculate the discount rate? Well, we simply need to add up the following parameters:

Real Risk Free Rate

Expected Inflation Rate

Default Risk

Liquidity Risk

Maturity Risk

We won’t go over how to calculate each of those things here, because it’s far too complex and is worth its own post, however when you put it all together we get a certain discount rate.

In order to determine the present value of a perpetuity, we simply take the annual return we get out of it, and divide it by the discount rate:

For a simple example, lets see the following:

Annual Return → 100

Discount Rate → 0.1

This means that our Future Value is:

Present Value → 1000

This means that this perpetuity is worth $1000 today, and you should not be willing to pay more than that for it.