About a year ago I opened a position in Foot Locker FL 0.00%↑ because I believe the company was dangerously undervalued.

A year on, the company has done nothing but going up, and is one of the best performers in my portfolio.

Given that the shares I purchased have a cost basis of $28.47 and the company is currently trading at $41 I got a 45% return in little over a year. Not bad!

You can read my original equity analysis here:

Let’s get started.

The Thesis

The first thing we need to take into consideration is to see what I thought about the company, and what my thesis for the investment was:

This is a simple and easily understandable retail sneaker business, with no moat

The digital sales channel provides an interesting growth opportunity, but the business as a whole is unlikely to grow much

Sales and earnings will likely meaningfully decrease in 2022

The company has no debt and a lot of cash in hand

The company will continue to be run like a cash cow and return most profits to shareholders. I expect around 400 million to be spent in 2022 on share buybacks

The primary thesis is that of a value play that will return to the mean, with a decent dividend and share buyback as a backstop

How has this held up?

Let’s take it point by point:

This is a simple and easily understandable retail sneaker business, with no moat

That hasn’t really changed in the past year!

The company continues to operate as a retail sneaker focused business with low margins and a thin moat.

This is one of the drawbacks of the company, and it continues to be a drawback today.

The digital sales channel provides an interesting growth opportunity, but the business as a whole is unlikely to grow much

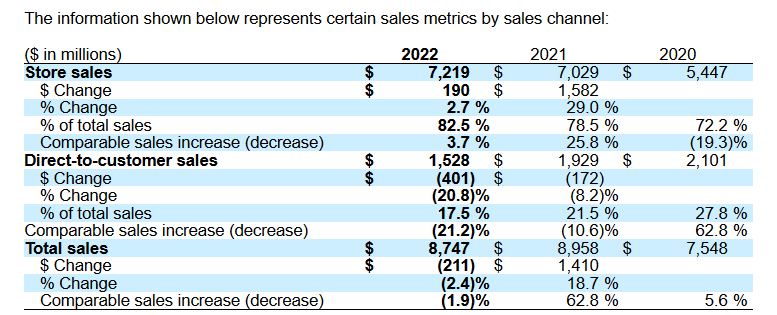

Well… I was wrong here:

In-store sales have actually increased with direct-to-customer sales being the main loser over the past 2 years.

Sales and earnings will likely meaningfully decrease in 2022

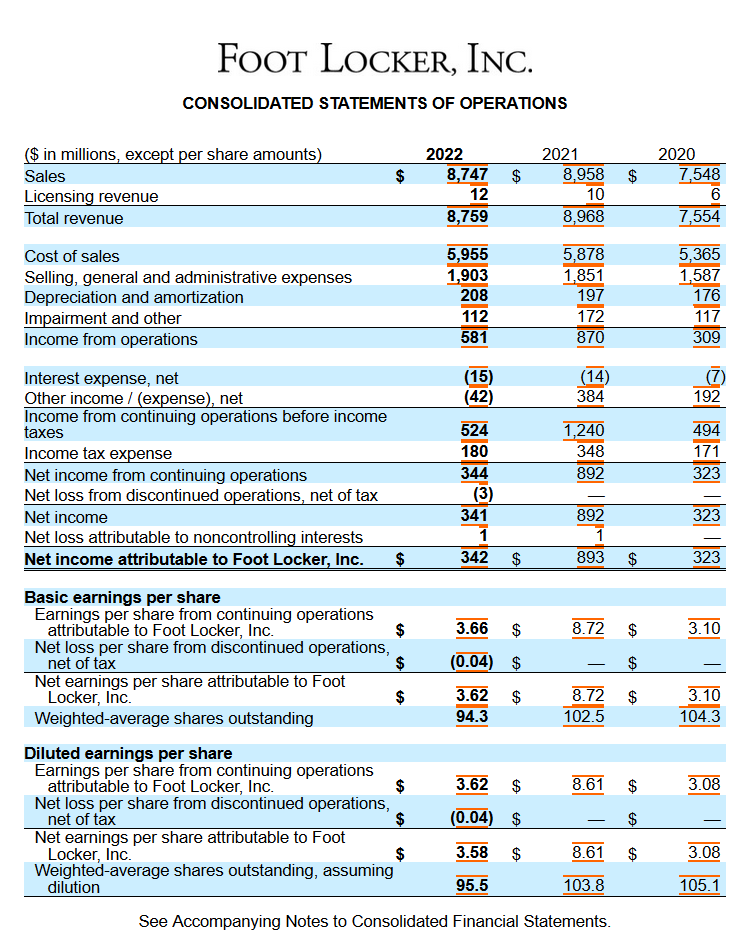

Sales and earnings have decreased in 2022 as expected, though not as much as I originally thought it would (we’re still above 2020 levels!)

Earnings per share too are fairly stable, and we can see there the impact that share buybacks have had in shareholder returns.

The company has no debt and a lot of cash in hand

The company continues to have substantially no debt, and while their stack of cash has decreased by $300 million from 2022 to 2023, that’s mostly the result of an increase in inventories.

Their balance sheet remains strong, unleveraged and otherwise capable of operating a profitable business while returning capital to shareholders.

The company will continue to be run like a cash cow and return most profits to shareholders. I expect around 400 million to be spent in 2022 on share buybacks

Well this was also a mistake with the actual numbers substantially below at $129 million.

In total the capital returned to shareholders was $279 million, whicch is still a substantial amount (especially given the lack of free cashflow to cover that cash spending!).

This gives me a current shareholder yield of 7.2%, which is good, but could be better, and hopefully next year will improve.

The primary thesis is that of a value play that will return to the mean, with a decent dividend and share buyback as a backstop

So far this has played out about how I expected with the company returning to its pre-crash valuation of about $40 per share.

While I still believe it is undervalued, I don’t think it’s undervalued enough to justify buying additional shares.

The future

Overall the company has turned out about what I expected with some notable mistakes in my predictions.

It-s clear that the valuation gap I originally saw has now closed substantially and so it’s now questionable whether or not I should remain invested in the company.

While it’s true that my original $60 fair value has not yet been met, it’s possible that the company’s fundamentals may have declined (that negative free cashflow I see in the cashflow statement!).

I’m seriously considering selling my position, but have not yet done so.

Current Stance: HOLD

Do you have any advice on what I should do? Let me know in the comments below!

Great write up. The decision to hold or sell I think depends on if your investment thesis has changed, if you see better opportunities elsewhere, or if you expect a recession/market slowdown.

You're paid a decent dividend while you wait for better opportunities, as you probably have a yield on cost around 6%. Also, they report earnings next week, and FL seems to usually beat expectations, which could bring the share price higher.

On the flip side, I'd say few people will buy new sneakers if a recession comes later this year.

Not investment advice, but personally I'd hold for now and reassess over the next few months.

Also thinking about the Options strategy you shared last week. If you have enough shares, you could sell covered call at the price you're happy to sell the shares at. (If I understood it correctly)

I'm more a buy-and-hold investor, I only sell when the investment thesis has changed, so these are just my own 2 cents :-)